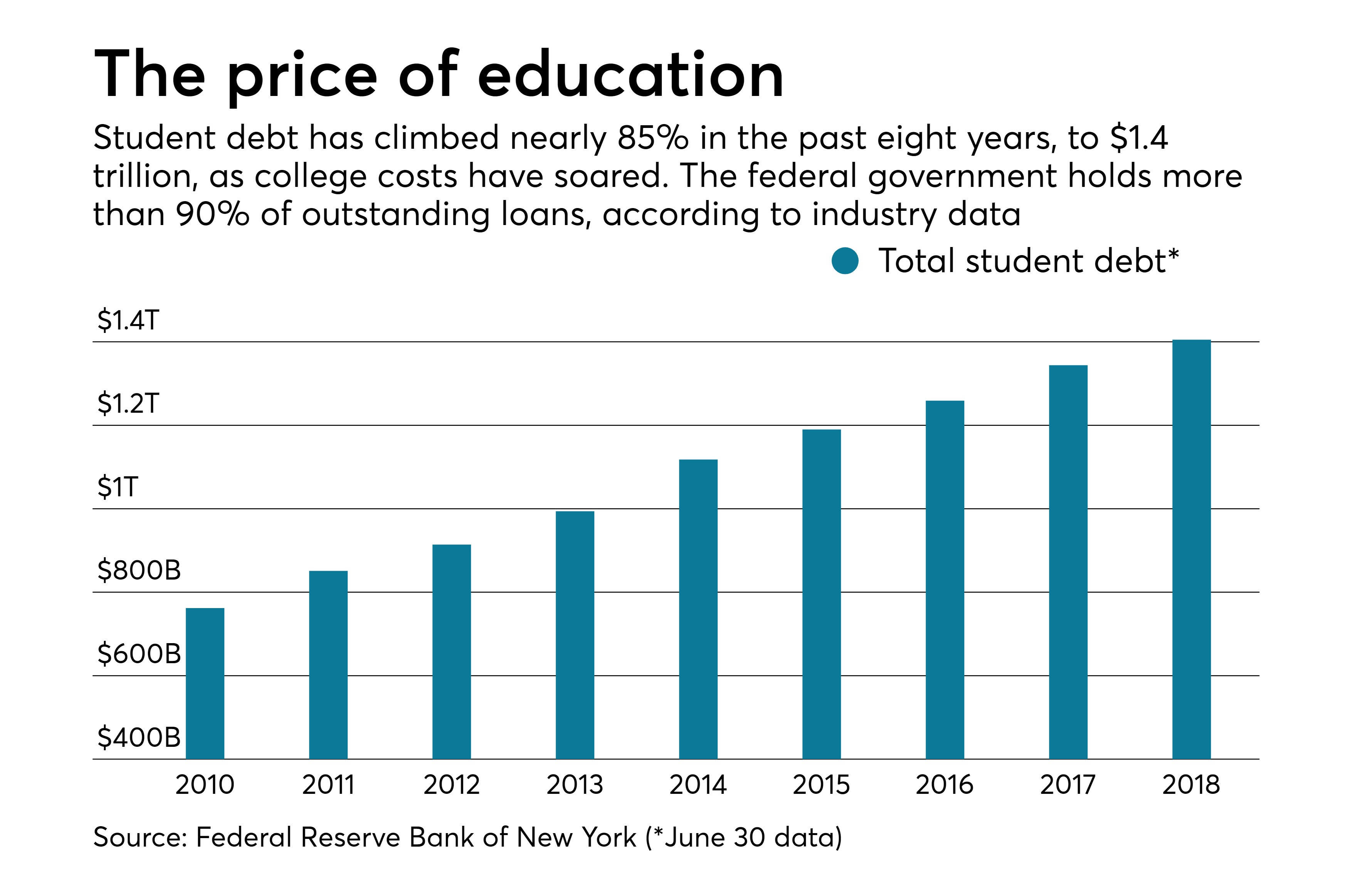

It is not a secret that tuition rates are growing exponentially at an alarming pace, with an overall student debt of $1.4 trillion affecting more than 44 million students, this crisis has become the second-largest source of household debt (After housing) and is the only form of consumer debt that continued to grow in the wake of the Great Recession. (Federal Reserve Bank of NY, 2018)

An influential factor behind the growing Student National Debt is the high demand for higher education, which leads to Schools to start discriminating students by raising the application fees, and requirements. Despite of this, students still have a high-willingness to apply to these schools even though a high portion of applicants will be rejected or waitlisted, the rejection of students decrease a school’s acceptance rate which increase the status and reputation of the school.

As previously mentioned, students have a high-willingness to apply to higher education because a large portion of young population consider that going to college is essential in order to be financially solvent in a market in which jobs are constantly lacking due to harsh competition. Factors such as the growing National Debt, Misallocation of resources, and growing population makes the supply for education more limited than it was decades before. Harsh competition and growing tuition rates (An average of $37,172 per student) (The Economist, 2014) makes specialization a hard task to do for the middle-class students, who are starting to rely more on Private Loans and Scholarships, making Public Education unsustainable and sometimes non-inclusive for non-Caucasian students.

Following a 2017 report released by the U. S Department of Education, non-Caucasian students (Hispanic/Latino, African American, Asian/Pacific Islander) tend to borrow more money in order to afford higher education, however, student from these ethnicities tend to take up to 12 years in order to fully repay their studies. The report brings a reason on the fact that Black students rely more on Sports scholarships rather than Academic merit, which on a larger scale means that the Quality of the Workforce will be greatly decreased.

On the other hand, the report also shows that White/Caucasian students coming from wealthy families borrow less money, making their college-careers solvent, and subsequently the chances of landing a job are greater than those students who borrowed more money.

Many economists, scholars and institutions believe that the Student Debt Crisis is an issue that will keep growing in the following years, it’s considered a collateral damage caused by the also growing National Debt. In order to achieve a turning point, there must be a general commitment not only from the U. S Department of Education, but also by Public/Private Institutions, as well as the Student population, a commitment in which all these parties achieve an equilibrium over this troubled Educational and Work market. As an economist would say, self-interest must be aligned with social interest in order to achieve a social good